If you distribute, monetize, or license your music with Songtradr – hopefully you do all three – we have some important announcements to share with you. As part of our commitment to providing you with the best tools to manage and monetize your music, we've updated our revenue platform to make it easier to track, report, and manage your income.

These updates will make processing your revenue data more manageable. To achieve this, we've added extended detail and song information for each transaction. This irons out the creases that previously made it difficult to identify and distribute money to multiple rights holders included in a single deal. Other changes include providing a simplified view of your earnings, making it easier to export your monthly revenue report, and offering a snapshot of your top five songs. Ultimately, we made these changes to provide you a more cohesive experience when interacting with our platform.

How do the changes benefit me?

Next time you log in to view your revenue and withdraw your earnings, things will look a little different. Here's a quick overview of what's new.

Let's take a closer look:

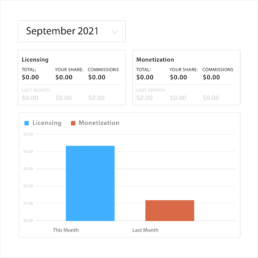

We've simplified your monthly report to provide clearer visibility of your monthly earnings, including your distribution royalties, licensing fees, and monetization revenue. You can now see the current month-in-progress and view monthly reports dating back to 2019.

In the 'Transactions' tab, we've added a "view detail" button so you can obtain detailed, exportable revenue reports. This will provide extended detail and song information for each transaction. From there, you can export the data to a CSV file for further processing.

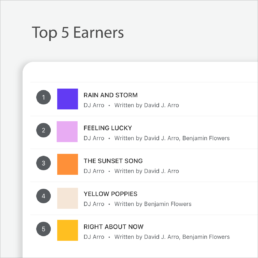

Require a quick snapshot to see which songs are performing well for you? You can now see your Top 5 songs that have earned the most revenue. This will assist your marketing or promotional efforts and help you reach even greater heights.

Want money transferred directly into your bank account? We've added an ACH payment option to make it seamless and straightforward to transfer your funds. Prefer Paypal? That option is still available with a 3% transaction fee.

We've also rewritten our code, making our site faster and more capable of displaying large amounts of data. This will provide additional support for labels and publishers representing large music catalogs.

Want to see these new changes in action? Here's a quick overview:

We need to talk about tax

Yes, we know it's the least fun topic to talk about. However, like sleep, tax is one of those things you can't avoid.

Beginning October 2021, every person withdrawing money from Songtradr will need to submit a tax form to comply with U.S. federal tax regulations. You will be required to submit this form before withdrawing funds from your Songtradr account.

For U.S. citizens and permanent residents, the process is relatively straightforward. You simply need to complete and upload a W-9 tax form with the information filled out correctly. You will only need to do it once unless your address or any other details change. Then, we will send you a corresponding 1099 form showing your yearly earnings at the end of the financial year. You can use the information on this form to file your U.S. tax return.

What if I don't live in the U.S.?

If you live outside the U.S. (and are not a U.S. citizen), you must complete and submit a different tax form. This form is called a W-8BEN (or W-8BEN-E if you are an entity). We require this form because Songtradr is a US-based company paying you, someone based in a foreign country. In many cases, submitting this form will have little impact on the money you receive from us. This is because your country of origin has a tax treaty with the U.S. that entitles you to a reduced withholding tax rate on U.S. income.

It is extremely important to complete this form correctly to claim the tax treaty benefit. If you complete this form incorrectly (or if your country of origin does not have a tax treaty with the U.S.), Songtradr may be required to withhold 30% tax on your behalf. This money will be paid to the IRS. You can find more information about international tax treaties, including a table that lists the countries that have tax treaties with the United States here. If you have additional questions about your personal tax obligations, we recommend talking to a tax accountant in your country.

Why are these forms important?

Every individual or company doing business in the U.S. must pay taxes. This includes anyone receiving royalty payments, licensing fees, or monetization revenue – no matter where you are based. It also includes other distribution services such as DistroKid, CD Baby, and Tunecore that pay artists. By collecting this form, we will be able to provide you with the required information to complete your tax return. Additionally, it will streamline the process for any third party that requires this information, such as your tax accountant. Ultimately, our goal is to make things easier so that you have more time to create music, which is why you came to us in the first place. We believe all the updates to our revenue platform achieve that.

Need more information?

Learn more

Nick Fulton

Before joining Songtradr, Nick spent more than a decade writing reviews, essays, criticism, and interviewing artists for i-D, Billboard, Pitchfork, and other global publications. He's spoken to hundreds of emerging and established artists, including Lenny Kravitz, Michael Stipe, Khruangbin, St. Vincent, Incubus, and Eartheater.

Awesome

hi, thanks for the info 🙂

DJ steve Francis

God bless you,

Thank for the information.

I have considered the tax situation, I live in Lagos Nigeria, I wanted you to be withdrawing my taxes payment when due, but I don’t agree to your term of 30%. But if 2% to 5% is allowed, that I agree, not 30% at all.

I am coming with hits tracks on 25 November 2021, so me no want disagreement. Remain blessed beloved.

Thanks, faithfully yours,

Cephas Israel.

Hi Cephas, every individual or company doing business in the U.S. must pay taxes. Since you live outside the U.S. and Songtradr is a US-based company paying you, you must complete and submit a W‑8BEN. If your country of origin has a tax treaty with the U.S. that entitles you to a reduced withholding tax rate on U.S. income, submitting this form will have little impact on the money you receive from us.

As we mentioned in this blog, it is extremely important to complete this form correctly to claim the tax treaty benefit. If you complete this form incorrectly (or if your country of origin does not have a tax treaty with the U.S.), Songtradr may be required to withhold 30% tax on your behalf, which will be paid to the IRS. You can find more information about international tax treaties, including a table that lists the countries that have tax treaties with the United States here. If you have additional questions about your personal tax obligations, we recommend talking to a tax accountant in your country.